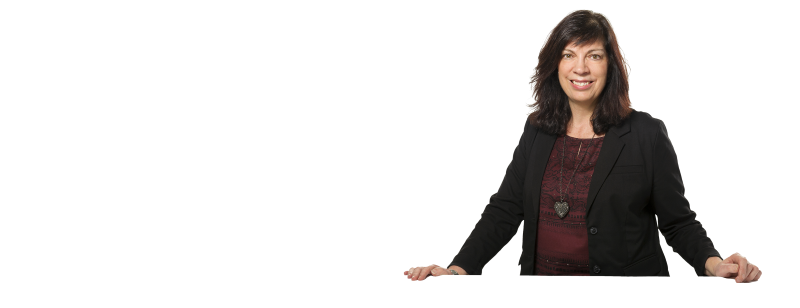

Tax Consulting

How to simplify your life

Today's tax system is highly complex and challenges increase. Changes in the tax law and new regulations may have an essential impact on the tax situation for private individuals and companies.

We support you to recognize fiscal risks at an early stage, to benefit from opportunities and to minimize tax burden.

Our services for private individuals

- Tax returns (all cantons)

- Tax planning / tax optimization

- Verifying tax assessments and tax invoices

- Tax objections and appeals as well as representation before tax authorities

- Refund of foreign withholding tax

- Tax consulting (including tax on property gains and double taxation, inheritance and donations)

Our services for companies

- Tax returns (all cantons)

- Tax planning / tax optimization

- Verifying tax assessments and tax invoices

- Tax objections and appeals as well as representation before tax authorities

- Refund of withholding tax and foreign tax at source

- VAT (registration, cancellation, accounting, consulting etc.)

- Fiscal tax representation in Switzerland and abroad

- Tax consulting in relation to annual financial statements with respect to tax optimization, calculation of tax liabilities

- Specific tax consulting (tax on property gains, withholding tax, stamp duties, turnover tax and emission charges as well as social insurance)

- Tax consulting in connection with incorporations, reorganization, transfer of domicile, recapitalization, restructuring, mergers and liquidations